The Magic Metric - What's The One Metric That Matters Most To Independent B2B Consultants?

Most people simply measure whether they get new clients or not. It's impossible to make good decisions if that's the only thing you're tracking. Let's do a deep dive into the metrics that matter.

Hi, I’m Rich, welcome to my consultancy newsletter. Please subscribe and check out my best articles.

Don’t begin hiring staff once you have more work than you can handle.

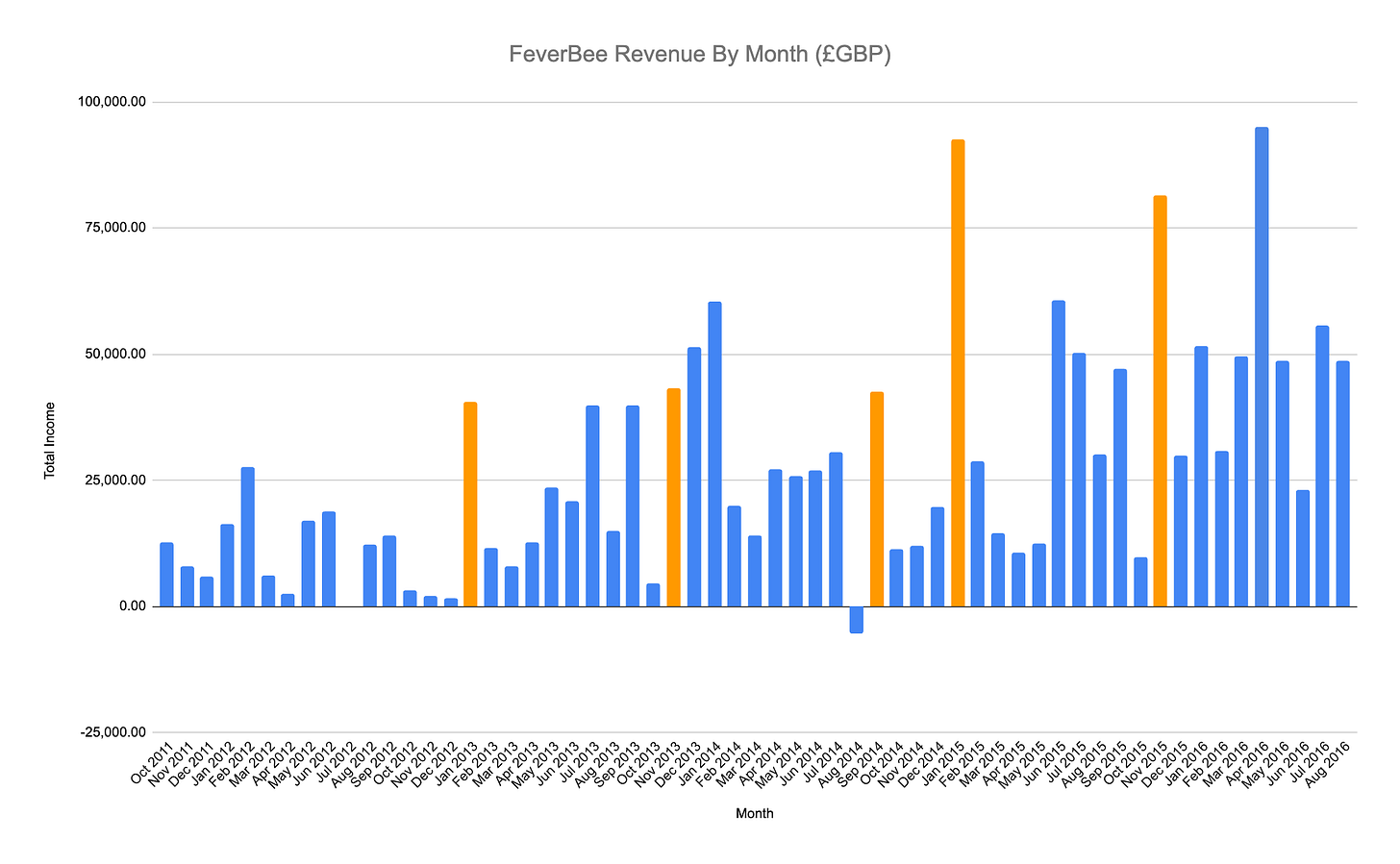

The reason for this is simple. It might be a lucky blip. You might be having a tremendous outlier month (or quarter). If we go back to my earnings in the first five years of consulting:

There are some huge swings from month to month. Sometimes we had 4x the amount of work we had the month before.

Now imagine what happens if you have a tremendous month (or quarter), hire staff to satisfy the increased demand, and then have a couple of regular months afterwards.

You’re going to wind up either laying off staff you just hired (tech companies in the post-pandemic era know this well) or paying staff to do non-essential activities. This is what’s known as low staff utilisation.

This is a challenge I faced circa 2016/2017. I grew the team to support additional work, but we suddenly lost two big clients and I …